Student Loans

Great Lakes Credit Union has everything you need to help manage your money and plan for the future.

We’re thrilled to share that as of June 1, 2024, the merger between encurage financial network credit union (EFNCU) and GLCU is now official. This exciting partnership brings expanded products and tools, increased convenience, and a stronger impact on our community. Our primary focus is ensuring that as members, you all have everything you need for a successful financial journey.

Here’s what you can look forward to as a valued GLCU member:

Both credit unions sought a partner that shares our passion, dedication, and loyalty to our teams, members, and communities. We found that in each other! By merging, GLCU and ENFCU can expand our reach to more individuals and families in need of financial services and education.

Together, we’ll increase our community investment, building on the 4,000+ volunteer hours and $30 million in community assets already saved, and enhance our resources to develop innovative programs that support financial well-being throughout our communities.

This merger will offer members:

Yes! You’ll gain immediate access to:

Even more products and services will become available later this year.

As a larger credit union, we’ll have more resources for continued growth and innovation. This translates to even more benefits for members, such as expanded product and service offerings, new technologies, and enhanced services. We’re committed to preserving the unique identities of EFNCU’s partner credit unions through advisory councils to ensure we remain close to all members and communities.

We’re working hard to make this a seamless transition. As the merger progresses, we’ll coordinate the consolidation of our systems and minimize any downtime for members. We are committed to keeping you informed every step of the way.

For now, you’ll continue using the same website (firstfcu.org), online banking, and mobile app as always. We’ll give you plenty of notice before any changes happen later this year.

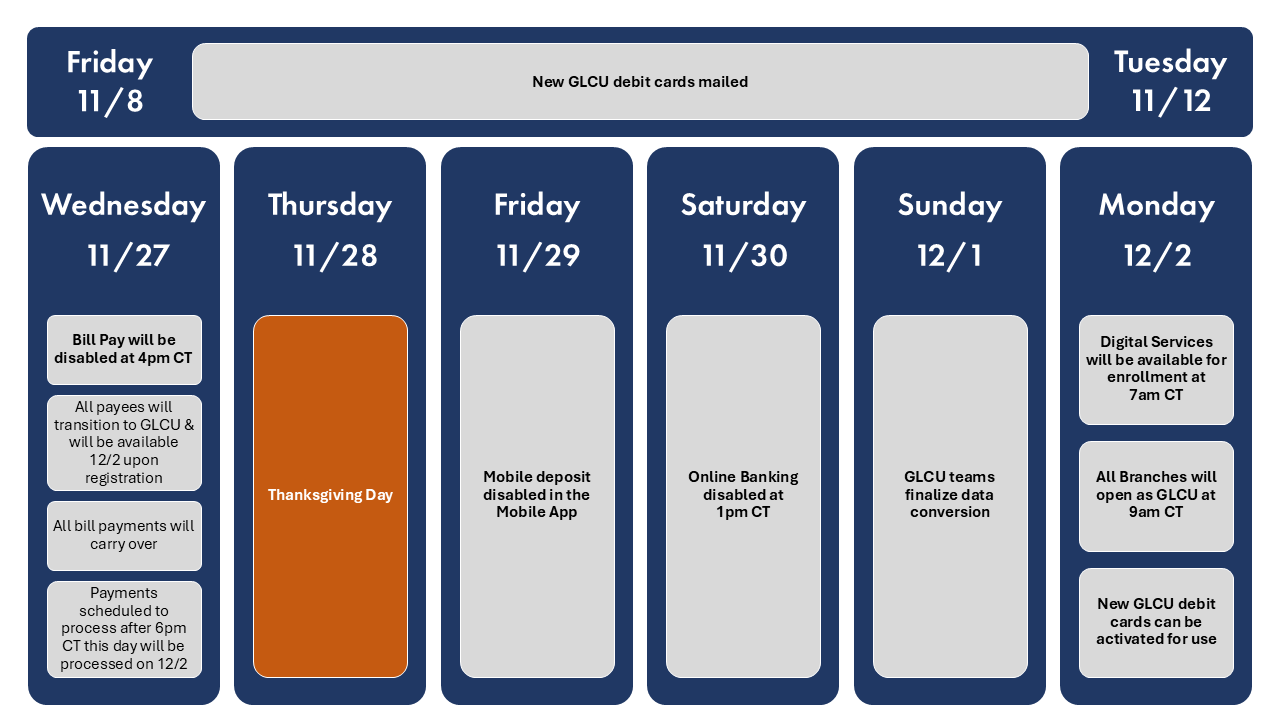

The conversion will take place during the weekend of November 30.

EFNCU online and mobile banking will be disabled at 1:00PM CST on Saturday, November 30, 2024.

Bill pay payees will be transferred to GLCU’s online bill pay system. In addition to transferring your payees, bill payments scheduled to be delivered on or after December 2, 2024 will be carried over and continue to process as scheduled. While we don’t anticipate errors during the transition we do recommend that you register for GLCU digital and verify your payment activity.

Beginning at 7am CST on Monday December 2, you can enroll and begin utilizing GLCU digital services to access and manage your accounts. In order to register successfully, you will need your 5 or 6-digit EFNCU member number, the email address on file, and your social security number.

Payments scheduled to be sent between November 28, 2024 and December 1, 2024 will be processed on Monday, December 2, 2024.

If you are currently enrolled in online or mobile banking, you can find your member number on your monthly account statement or you can contact EFNCU and we’d be happy to assist.

Access to EFNCU online and mobile banking will be disabled beginning at 1 pm CST on Saturday, November 30.

You can update your contact information through the EFNCU online or mobile banking. If you are experiencing difficulties accessing your account online, please contact us and we’d be happy to assist.

Mobile deposit through the EFNCU mobile app will be disabled at the end the business day on Friday November 29, 2024.

This merger allows us to implement best practices for greater positive impact on our members, employees, and communities. We’ll expand our branch network across the Chicago area, increasing our responsiveness to members’ financial needs. Additionally, this partnership will allow us to expand EFNCU’s community programs through the GLCU Foundation for Financial Empowerment. Together, we’ll serve over 94,000 members and hold approximately $1.5 billion in assets, creating a stronger combined organization.

Fixed-rate loans and deposit products will remain the same. For variable-rate accounts, we are committed to offering competitive rates.

GLCU has lower or no fees on many services, so you’ll likely save money. We’ll provide a full fee overview closer to the system integration.