Student Loans

Great Lakes Credit Union has everything you need to help manage your money and plan for the future.

|  |  |

We help you identify | We help you create | With our support, you achieve your goals |

Interested in improving your overall financial health? Our NCHEC and HUD-Certified counselors can advise you on virtually every aspect of your finances. Whether looking for immediate relief or planning for brighter futures tomorrow, we will create a customized plan to help achieve your goals!

See our full list of upcoming events here.

Looking to make a purchase or in need of rental or mortgage assistance? GLCU’s expert NCHEC and HUD-Certified counselors can walk you through every step of the process. Let GLCU guide you through the home buying, rental experience, or home maintenance process.

There are other specific pandemic-related options to help keep you in your home, and we can help you with those too.

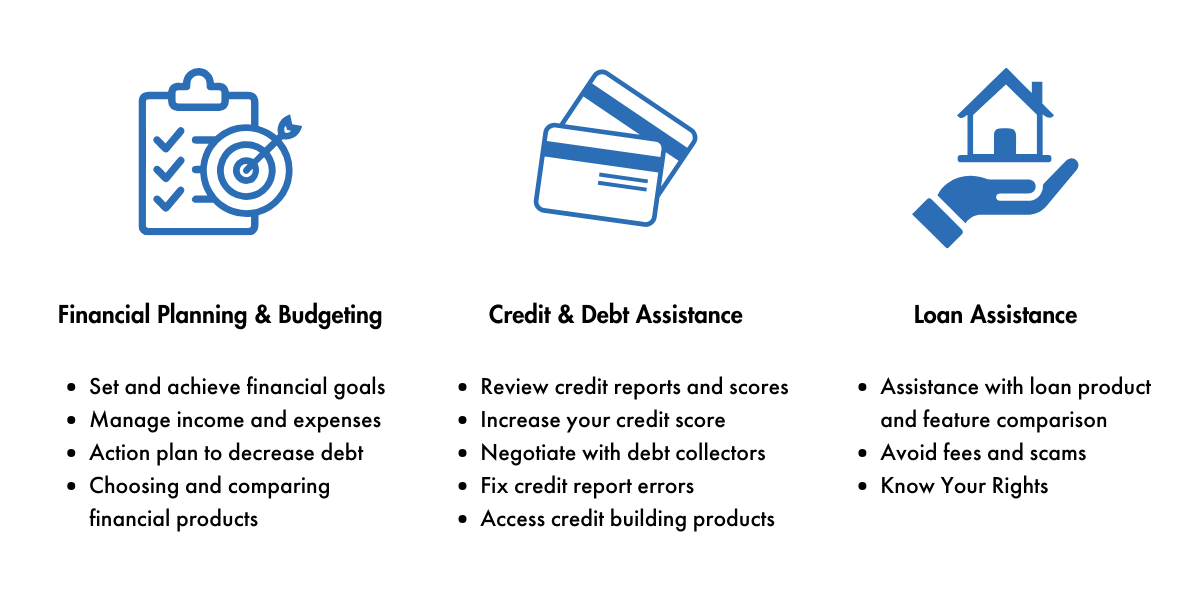

We’re a trusted source of information and support within our community. Our confidential and certified housing and financial counselors can offer a range of services to help you achieve your goals.

Schedule a consultation to talk with one of our professional housing and financial counselors.

To register for our online homebuyer course visit https://www.ehomeamerica.org/glcu

You can also schedule your Housing and Financial Counseling appointment by calling us directly at 224-252-2620.

No. Not at all, and usually it’s the opposite. People who participate in financial counseling usually improve their financial situation and credit score.

Typically, a session or meeting lasts about 45-120 minutes. But all counseling sessions are tailored to meet your individual needs, so the exact length of the sessions varies.

No. If you participate in counseling through GLCU Foundation for Financial Empowerment there is no charge or cost. This is one of the benefits of being a Great Lakes Credit Union member.

Yes. Absolutely. Everything you discuss is confidential. Our counselors are professionals who abide by the highest standards and are endorsed by the United States Department of Housing and Urban Development (HUD)and the NeighborWorks Center for Homeownership Education and Counseling (NCHEC).

A Comprehensive Guide to Building Good Credit

Click Here

Turning a House into a Home: 8 Financial Tips for New Homeowners

Click Here

Six-year foreclosure court battle finally ends, thanks to GLCU Foundation Housing Counselor's Tenacity

Click Here