Student Loans

Great Lakes Credit Union has everything you need to help manage your money and plan for the future.

It’s time to start banking for a greater good.

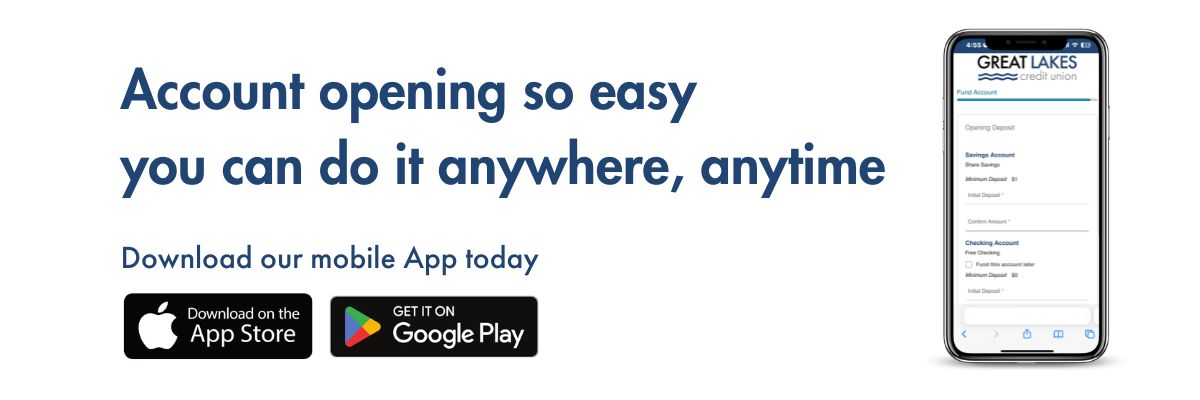

Open an account with Great Lakes Credit Union and get competitive rates, financial education and tools, and 24/7 access from anywhere – all while supporting financial empowerment in your local community.

| Step 1 | Fill out our application; it takes 5 minutes or less. |

| Step 2 | Select the accounts you want to open. |

| Step 3 | Download the GLCU Mobile Banking app so you're ready to access your account. |

New Member | Existing Members |

We're glad you're here. | Thank you for your membership. |

| Get Started | Log in to Online Banking |

Download our app

*Anyone interested in opening a GLCU account can now do so typically within one business day, thanks to GLCU’s partnership with Plaid, a fintech company that facilitates communication between financial services apps and users' banks and credit card providers. Read GLCU’s privacy policy as it relates to Plaid here.

Federally insured by the National Credit Union Administration.