Student Loans

Great Lakes Credit Union has everything you need to help manage your money and plan for the future.

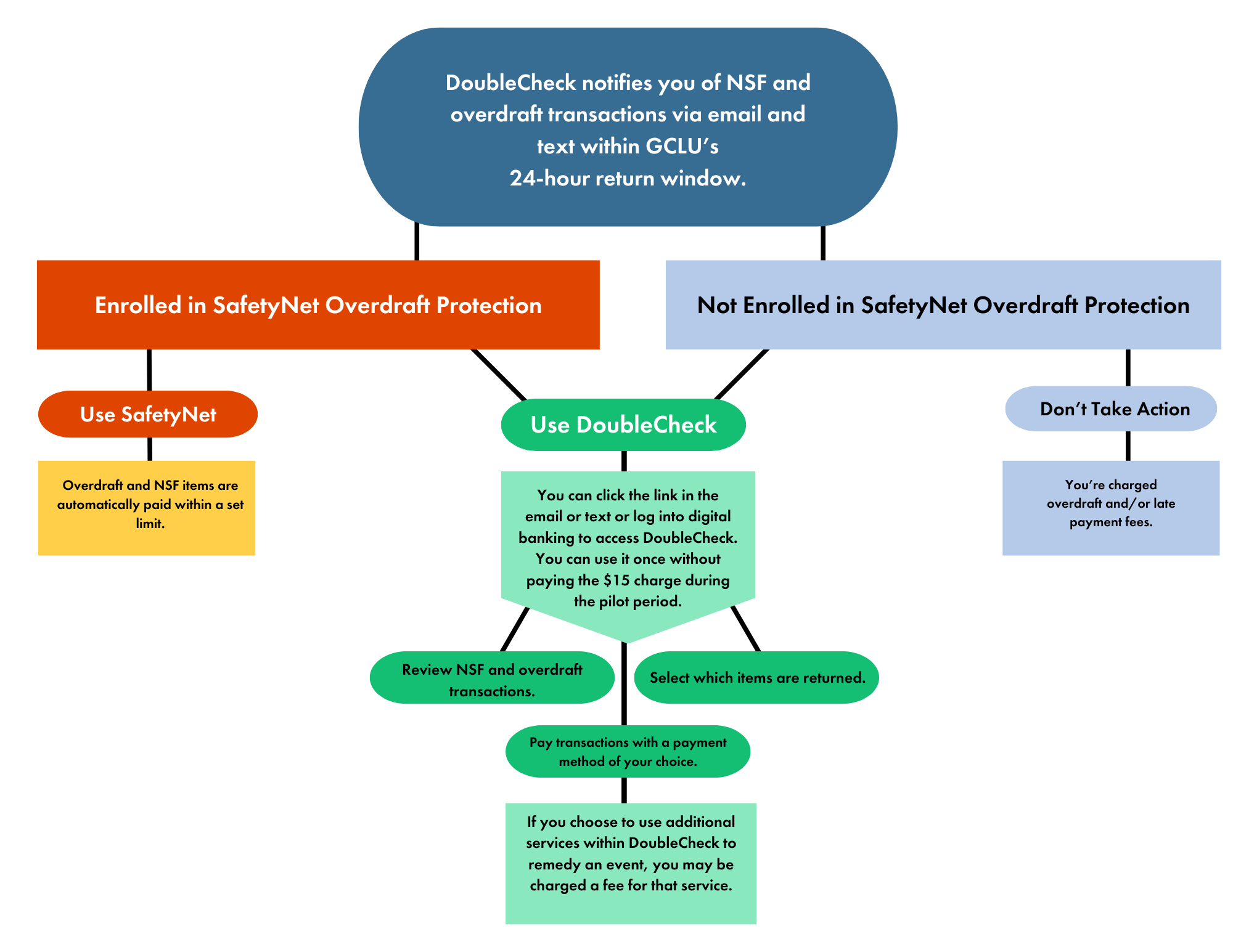

We recognize that managing overdraft and NSF transactions is a pain point for many of our members. That’s why we’re launching DoubleCheck, a new service that alerts members of overdraft and non-sufficient funds (NSF) transactions.

We’re inviting you to participate in a DoubleCheck pilot program that we think will help make managing your finances a little easier. DoubleCheck alerts you via email and text message about NSF and overdraft items that need your attention. You can click on the link in the email or text or log in to digital banking to access DoubleCheck. You can then choose to return the transactions or pay them in a way that is most convenient for you.

Watch this video to learn more about how DoubleCheck works.

In this DoubleCheck Service Terms and Conditions (“Terms and Conditions”), the terms “you” and “yours” refer to the member enrolling in the DoubleCheck Service (“DoubleCheck”), and “we,” “us,” “our,” “ours,” and “Credit Union” refer to GLCU. These terms and conditions are in addition to your account terms and conditions.

DoubleCheck is a new tool that provides you with more options for managing your Credit Union checking account when the available balance is lower than the amount needed to cover items being presented for payment. These items are considered non-sufficient funds (NSF)

This new tool includes:

Alerts - Alerts are automatically sent using the current contact information on your account. This contact information includes email and the phone number provided for the member listed on this account as the primary accountholder. You are responsible for providing accurate and up-to-date contact information.

At GLCU, a “business day” is every day except Saturday, Sunday, and Federal Reserve holidays.

Time to Act - You will have a specific amount of time to take action. This time will be included on your alerts and on the DoubleCheck system. If your account available balance becomes insufficient on a business day, you have until 12:30 PM CST, on the next business day to make your decisions to “Pay” or “Return” the items, as well as pay any amount due in order for your request to be honored. Your “Time to Act” time period begins when you receive your alert and will end when the time designated on your alert expires. If you make a deposit, the time it takes for your deposit to be reflected in your available balance and for those funds to become available to you will vary based on the deposit type and time. Depending on your deposit type or your deposit time, your deposit may not be available before your time to act period expires. Generally, if a deposit is received before our 6:30 PM CST cut-off time on a business day, we will consider that to be the day of deposit. However, if a deposit is received after our cut-off time or on a day that is not a business day, we will consider the deposit as being received on the next business day. Refer to our Funds Availability policy to determine when your deposit may be available. Your “Time to Act” will appear on your DoubleCheck screen after you have signed in. The “Time to Act” countdown clock, located at the top of each screen, will show you how much time remains before your “Time to Act” period expires.

Other Transactions - Other transactions on which you made or authorized new withdrawals from your account will change the negative available balance. Additional withdrawals from your account that contribute to the negative amount of your available balance will not restart your “Time to Act” or change the amount of time available in your “Time to Act” period. The timing of your negative balance or other alerts will not impact the amount of “Time to Act”.

Please note that while the “Time to Act” gives you additional time to make decision changes and remedy your insufficient balance, the “Time to Act” does not pause or delay any reporting regarding an account’s negative balance, items returned due to insufficient funds, or overdraft activity. Overdrawing an account, maintaining a negative available balance for any period of time, and returning transactions as unpaid may have other impacts including account closure or negative impacts to your ability to obtain financial services including loans, deposit accounts, and other services. We will not be liable for damages or wrongful dishonor if you choose to return an Item unpaid or fraudulent.

DoubleCheck Payments- Payment options may be presented when the available balance in your Account is negative. Payments allow members whose Account has a negative available balance to review and manage certain check payments, ACH items or debit card transactions (collectively, “Items”) which will post to your account and contribute to the negative available balance. Payment options will be made available at our discretion. Not all members will have access to DoubleCheck, and payment decisions will not be available on all Items. You will not be offered the option of DoubleCheck if your account’s available balance remains negative for an extended period of time as determined by the credit union. Certain other items may not be eligible to be returned. i.e. ATM withdrawals and, on-us check cashes to name a few. DoubleCheck is not available to use outside of the “Time to Act” period.

For DoubleCheck NSF Items, you may be presented an option to pay the Item (which will create an overdraft and contribute to the negative available balance in your account) or to return the Item as unpaid (which means the Item will not be paid and will no longer contribute to the negative available balance in your account). When you are presented with the option to pay or return an Item, you will be able to view the time remaining to make a decision on each Item in the decision screen. You will see Items being returned, Items reported as fraudulent, if any, and Items you have decided to “pay”. You may select the appropriate payment option and follow the instructions to complete your transaction.

If you take no action or if you do not make a payment that increases your available balance that is sufficient to pay the Items you selected to pay, the Credit Union’s standard operating procedures will prevail when the “Time to Act” expires.

Authorized Signers - Any authorized signer on the account may make “pay” or “return” decisions. If any signer submits a decision to return or pay an Item in DoubleCheck, the decision may not be changed even if it is prior to the expiration of the “Time to Act” period.

GLCU reserves the right to decline to pay an Item even if you have selected to have the Item paid where, in our judgment, fraud is suspected or where the Item cannot be processed. Items returned in DoubleCheck may be resubmitted by the payee. As a result, Items that you have returned may appear in DoubleCheck again if the resubmission of an Item contributes to your account’s negative available balance. A record of Items that you have chosen to pay/return will be available in the DoubleCheck NSF History within the DoubleCheck system. When you choose to return an Item that has been presented to us for payment, we will return the Item to the payee’s financial institution for insufficient funds, and the payee will not receive payment from GLCU. You may still have an obligation to pay the payee for goods, services, or other products. We are not responsible for satisfying any obligations between you and the payee or any other party with respect to an Item you decide to return. Before choosing to return an Item, you should consider rules the payee may have or actions the payee may take on late/returned payments.