Student Loans

Great Lakes Credit Union has everything you need to help manage your money and plan for the future.

Money SmartsYouth & MoneyMarch 8, 2024

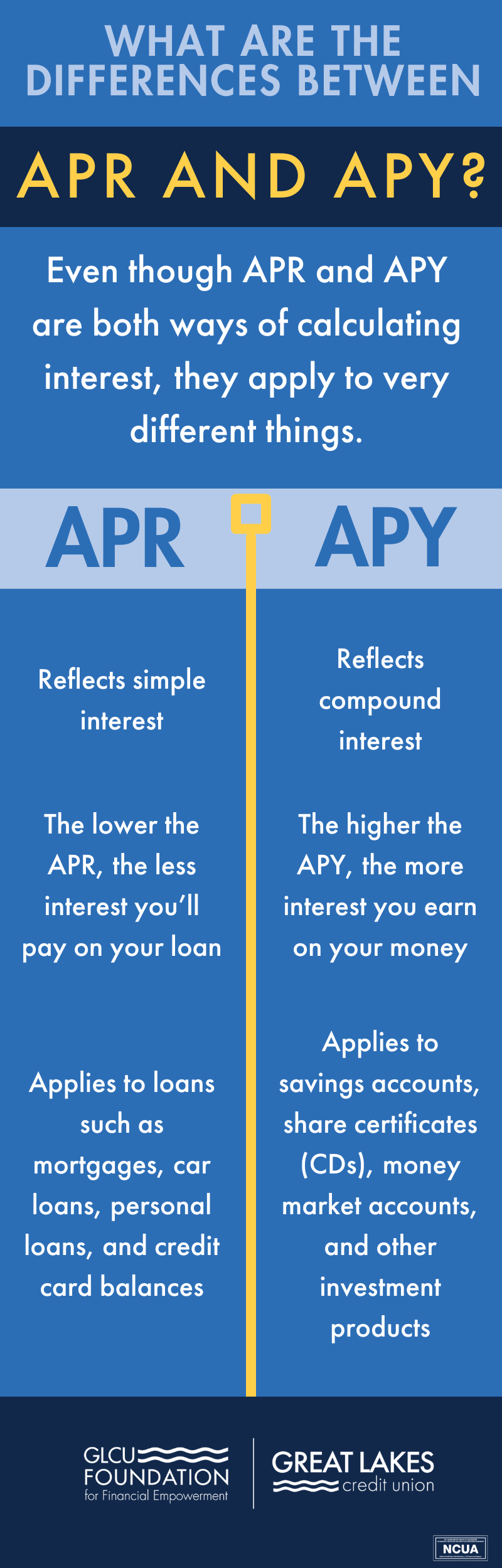

If you're considering opening a savings account, taking out a loan, or applying for a credit card, it's important to understand certain financial terms. APR and APY are two terms that are often confused. Even though both APR and APY are ways of calculating interest, they apply to different things.

Keep reading to understand the differences between APR and APY.

APR stands for annual percentage rate. APR reflects the cost you pay each year to borrow money (including fees) expressed as a percentage. This rate refers to the amount of interest you’ll pay on loans or credit card balances.

When you take out a loan, you typically have to pay back the original amount plus interest. Your interest rate will vary depending on the type of loan you choose and your specific financial situation, including the length of the loan and your credit score, among other factors.

APR is your yearly interest rate, inclusive of any costs or fees linked to your loan. Evaluating APRs from various loans or lenders can help you find the most suitable financial option for you. For credit cards, you can avoid paying interest and fees on purchases if you pay your balance in full and on time each month.

Some credit cards offer an introductory 0% APR on balance transfers from existing cards. This can help you avoid paying interest if you know you’ll have the funds available to pay the balance down the road. Just make sure to pay the balance in full before the intro period ends to avoid paying interest on your balance transfer.

APY stands for annual percentage yield. APY is the amount of interest earned in savings accounts or other investments yearly, rather than interest paid on a loan. The higher the APY, the more interest you’ll earn on your money. APY includes compound interest while APR does not.

In simple terms, compound interest is interest you earn on top of interest as your balance grows. With compound interest, you earn money on both the initial deposit and the interest that accumulates over time. If you’re looking to save or invest, you’ll want to compare the APY and consider how often the product’s interest compounds.

You'll want to aim for the lowest APR on loans to save on interest payments. Also, remember to pay your credit card balance in full and on time each month to avoid interest and fees. Having the highest possible APY will help you maximize your savings.

As a not-for-profit credit union, GLCU promotes the financial well-being of our members. In addition to our many educational resources and outreach efforts, we also give back our profits to our members in the form of reduced or eliminated fees, higher savings rates, and lower interest rates on loans. Check out our rates and consider opening an account today.