Student Loans

Great Lakes Credit Union has everything you need to help manage your money and plan for the future.

Money SmartsJuly 21, 2023

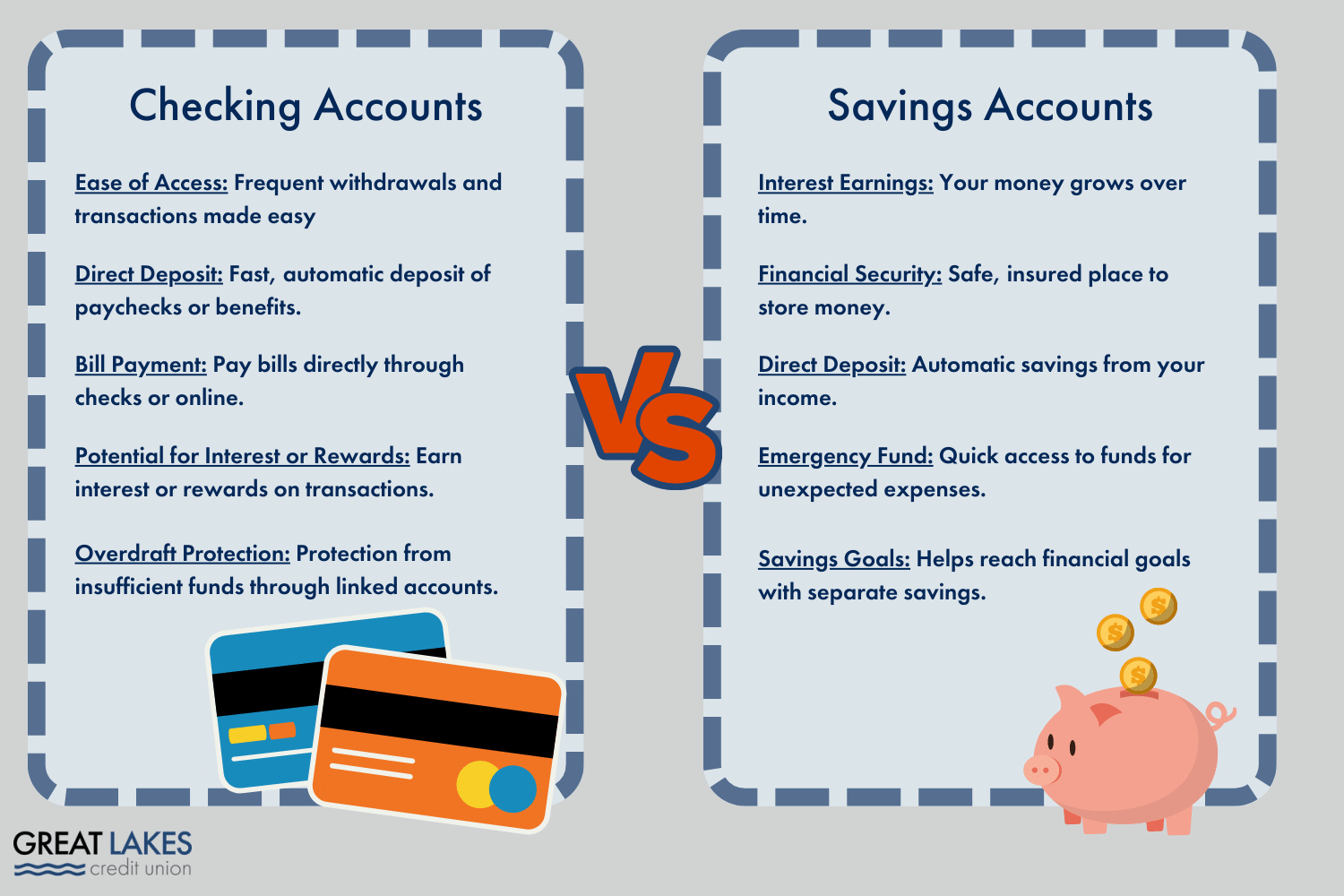

A checking account and a savings account serve two different, but complementary, roles in managing your personal finances. A checking account is primarily used for daily transactions, allowing you to deposit money and make frequent withdrawals. These accounts are typically used for paying bills, making purchases, and managing everyday expenses, and are sometimes interest bearing. They are designed for ease of access to your funds, often providing check-writing privileges, debit cards, and online banking services for quick transfers and payments.

A savings account is intended for money you plan to grow over time. These accounts sometimes limit the number of transactions you can make each month, but they offer the advantage of accruing interest on your balance. This makes a savings account ideal for setting aside funds for future needs or emergencies. They serve as a tool to facilitate saving habits, allowing you to accumulate wealth gradually while providing a safety net for unforeseen expenses. It's common to direct deposit into savings accounts, establishing a systematic saving routine. Not sure what’s right for you? Read on to learn more

Key Takeaways

What is a Checking Account?

A checking account is a type of financial account that allows for numerous withdrawals and unlimited deposits. Unlike other types of accounts, it enables frequent transactions, including deposit demand via checks, debit card purchases, and direct transfers. A key characteristic of a checking account is its liquidity and accessibility, making it an ideal tool for managing daily financial activities.

Is a Checking Account a Bank Account?

Yes, a checking account is a type of bank or credit union account. It is a service provided by financial institutions like banks and credit unions that allows customers to deposit and withdraw money. Due to its function of facilitating regular transactions, many people use a checking account for their primary banking needs, making it a fundamental component of personal finance.

Benefits of a Checking Account

Checking accounts come with a variety of benefits, including:

How to Choose a Checking Account

Choosing the right checking account depends on your financial habits and needs. Consider factors such as the minimum balance requirements, fees (such as monthly maintenance or ATM fees), ease of access to your money, and any additional perks offered by the financial institution. Some people may prefer a traditional brick-and-mortar bank or credit union, while others might opt for online banks or credit unions for their checking accounts.

Alternatives to Regular Checking Accounts

Alternatives to regular checking accounts include high-yield checking accounts, which often offer lower fees and higher interest/dividend rates; money market accounts, which can also offer higher interest rates but may require a higher minimum balance; and prepaid debit cards, which work like a checking account but without the need for a bank.

What is a Savings Account?

A savings account is a type of interest-bearing account offered by banks and credit unions. Unlike checking accounts, savings accounts are intended to hold the money you don't intend to use for daily expenses. They often limit the number of transactions you can make each month but offer the advantage of accruing interest over time.

Benefits of a Savings Account

Savings accounts offer several key advantages, including:

Can You Deposit Checks into a Savings Account?

Yes, you can deposit checks into a savings account. Most banks and credit unions allow for this. You can do this either in person, via an ATM, or through a mobile banking app if your bank offers mobile check deposit.

How to Choose a Savings Account

Choosing a savings account depends on factors such as the interest rate, minimum balance requirements, fees, and how you plan to use the account. Look for an account with a competitive interest rate and low fees. Consider online savings accounts or money market accounts (MMAs), as they often offer higher interest rates compared to traditional savings accounts.

Alternatives to Regular Savings Accounts

Alternatives to regular savings accounts include high-yield savings accounts, which offer higher interest rates; Certificates of Deposit (CDs), which also have higher interest rates but limit access to your funds for a certain period; and MMAs, which usually have higher minimum balance requirements but offer both check-writing privileges and higher interest rates.

Benefits of Having a Checking and Savings Account

Having both a checking and savings account provides financial flexibility. Your checking account can cover everyday transactions while your savings account builds interest and serves as an emergency fund or future investment. This strategy can also help manage your money, separating daily spending from savings.

Are Interest Rates Fixed on Savings and Checking Accounts?

Interest rates on checking and savings accounts are typically variable, not fixed. They can fluctuate based on economic conditions and changes in the Federal Reserve's interest rate policies.

Will I Lose My Money in a Checking or Savings Account if My Bank or Credit Union Fails?

If your bank or credit union is federally insured by the Federal Deposit Insurance Corporation (FDIC) or the National Credit Union Share Insurance Fund (NCUSIF), your deposits are generally protected up to $250,000, minimizing the risk of losing your money.

Should My Checking and Savings Account be at the Same Bank or Credit Union?

There's no one-size-fits-all answer to this question. Having both accounts at the same institution can make transfers between accounts faster and easier. However, you might find that different institutions offer better rates or benefits for different types of accounts. It's essential to shop around and choose what's best for your needs.

How to Choose What’s Best for You

When it comes to checking vs savings accounts, the choice depends on your financial goals and habits. A checking account might be best for managing everyday expenses, while a savings account is better for building an emergency fund or saving for future goals. Remember to consider the fees, interest rates, access to your money, and the reliability of the financial institution. And always feel comfortable to ask for advice from financial advisors or banking professionals to help guide your decision.